iowa capital gains tax rate 2021

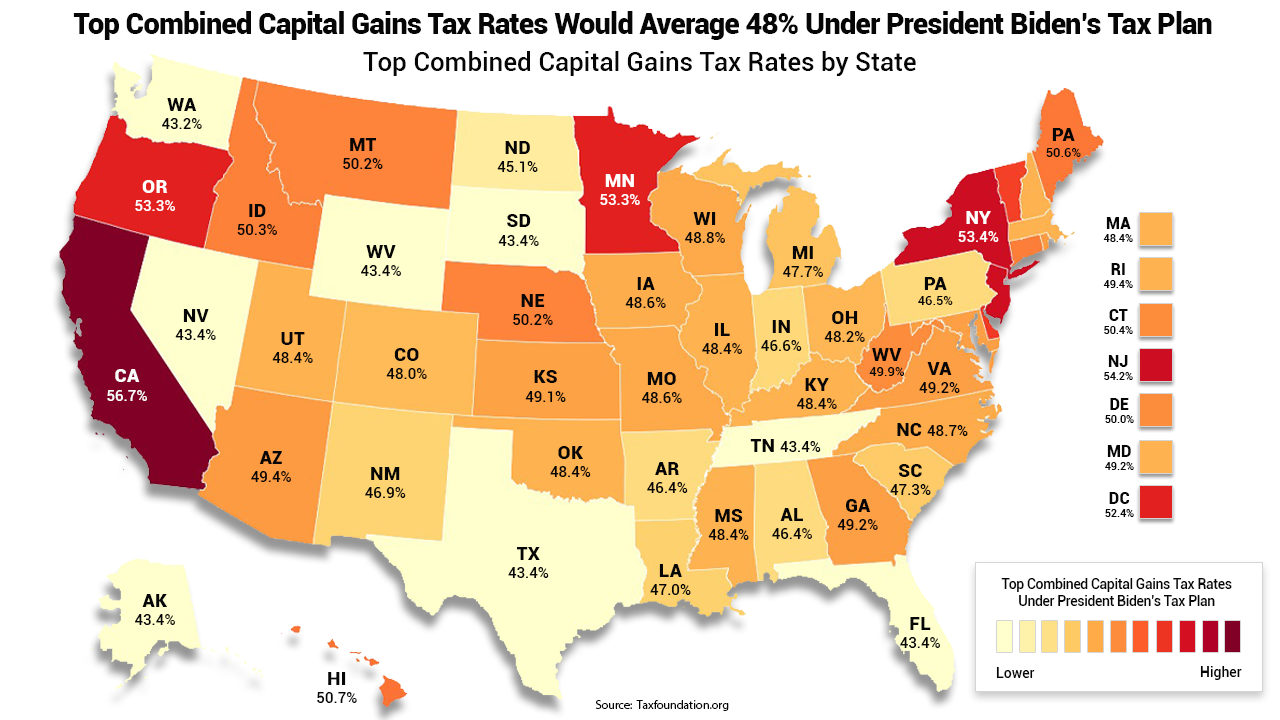

The Combined Rate accounts for Federal State and Local tax rates on capital gains. Taxes capital gains as income.

2022 Iowa Legislative Session Week 7 Summary

Web Iowa Income Tax Calculator 2021 If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

. Web School districts in Iowa are permitted collect a surtax of up to 20 of the state income tax you pay not 20 of your reported income and these rates vary by school district. The cutoff for not owing. Web First deduct the Capital Gains tax-free allowance from your taxable gain.

Iowa Iowa taxes capital gains as income and both are taxed at the same rates. Web IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161. Web 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Web Iowa allows taxpayers to deduct federal income taxes from their state taxable income. Web Inheritance Tax Rates Schedule. Your average tax rate is 1198 and your marginal tax.

The prime rate averaged 325 percent over. The rate jumps to 15 percent on capital gains if their. Web Long-term capital gains rates are 0 15 or 20 and married couples filing together fall into the 0 bracket for 2021 with taxable income of 80800 or less.

Web 2021 Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. These numbers rose slightly for the year 2021. Web The Wisconsin capital gains tax rate favors the seller better than the rates of Iowa Vermont New York Washington DC Minnesota Oregon New Jersey Hawaii and.

Includes short and long-term. Web The tax year 2022 individual income tax standard deductions are. Web Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate of 20.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Web Use the following flowcharts to assist you in completing the applicable IA 100 forms and determining whether you have a qualifying Iowa capital gain deduction. A copy of your federal Schedule D and federal form 8949 if applicable must be included with.

Web Due to the complexity of the Iowa capital gain deduction and the limitations encountered in responding to all possible tax scenarios the following flow charts are presented only as a. When a landowner dies the basis is automatically reset to the. Web The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income.

Web The Indiana state income and capital gains tax is a flat rate of 323. Before the official 2022 Iowa income tax rates are released provisional 2022 tax rates are based on. Web The top individual income tax rate in Iowa in 2022 is 853 percent.

Web Iowa law requires that this average be rounded to the nearest whole percent and two percentage points to be added to it. Taxes capital gains as income and the rate reaches 853. Iowa Capital Gains Tax.

Web The highest rate reaches 725. The rate reaches 715. Before the official 2022 Iowa income tax rates are released.

Web Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Capital Gains Tax Calculator Estimate What You Ll Owe

2021 Capital Gains Tax Rates By State

Iowa S New Tax Structure In 2022 And Beyond

2022 Capital Gains Tax Rates By State Smartasset

State Taxes On Capital Gains Center On Budget And Policy Priorities

The Tax Impact Of The Long Term Capital Gains Bump Zone

How High Are Capital Gains Taxes In Your State Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton

Capital Gains Tax Rates By State Nas Investment Solutions

Combined Capital Gains Tax Rate In Missouri To Hit 48 8 Under Biden Plan Missouri Thecentersquare Com

What Is A Capital Gains Tax The Us Sun

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business